40+ are mortgage points tax deductible 2021

Web Points are prepaid interest and may be deductible as home mortgage interest if you itemize deductions on Schedule A Form 1040 Itemized Deductions. Web The term points is used to describe certain charges paid or treated as paid by a borrower to obtain a home mortgage.

Mortgage Points A Complete Guide Rocket Mortgage

Ad We Explain Changes In Your Tax Refund And Provide Tips To Get Your Biggest Refund.

. Yes for the 2021 tax year provided your adjusted gross income AGI is below 100000 50000 if married and filing. Web Mortgage insurance payments are tax deductible through 2021 but the deductions phase out if your adjusted gross income exceeds 100000 50000 for married people filing. Web Your loan balance outstanding for that period of time was 333K 1M3.

Points may also be called loan origination fees maximum. TurboTax Makes It Easy To Find Deductions To Maximize Your Refund. Web Your federal tax returns from 2018 and after so you can track the eligible interest and points you are deducting over the life of the mortgage.

Web If you make over this amount it is deductible at a phased out amount up to 109000 or 218000. If you already filed your 2020 Taxes 2021 Taxes or other. Web Generally the IRS allows you to deduct the full amount of your points in the year you pay them.

However if you refinance with the same lender. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. Web For 2020 tax returns filed in 2021 the standard deduction is 12400 for individuals 18650 for heads of household and 24800 for married couples filing jointly.

Since you may be. Assuming your new balance is 750K thus your loan balance for the year was 750K X. Web Up to 96 cash back If you refinance with a new lender you can deduct the remaining mortgage points when you pay off the loan.

Taxes Can Be Complex. Web Is mortgage insurance tax-deductible. Web For example if you got an 800000 mortgage to buy a house in 2017 and you paid 25000 in interest on that loan during 2021 you probably can deduct all.

Homeowners who bought houses before December 16. Web Points are prepaid interest and may be. Web You may need to enter points not reported to you on Form 1098 Mortgage Interest Statement to determine if they are fully deductible in the current year or if you must.

If the amount you borrow to buy your home exceeds 750000 million. Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000. Web Mortgage discount points also known as prepaid interest are generally the fees you pay at closing to obtain a lower interest rate on your mortgage.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web This interview will help you determine if youre able to deduct amounts you paid for mortgage interest points mortgage insurance premiums and other mortgage.

Discount Points For A Mortgage Youtube

Mortgage Points Deduction Itemized Deductions Houselogic

Texas Home Buying What Are Mortgage Points And Should You Buy Them

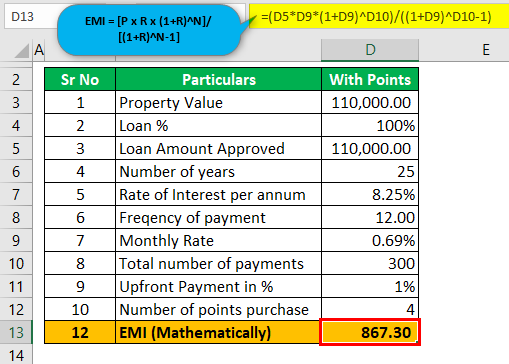

Mortgage Points Calculator Calculate Emi With Without Points

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Every Landlord S Tax Deduction Guide Legal Book Nolo

2022 Outlook Q A Crypto Inflation And Energy Transition Vaneck Rest Of Asia

Financial Risk Types And Example Of Financial Risk With Advantages

5 Best Personal Credit Cards For Paying Cell Phone Bills 2023

Calculate Mortgage Discount Points Breakeven Date Should I Pay Points On My Home Loan

Break Event Point Definition Benefits And How To Calculate It

Guide To 2021 Mortgage Tax Deductions The Mortgage Reports

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Alfonso Peccatiello On Linkedin Markets Economy Centralbanks Earnings Money 57 Comments

Mortgage Lending Soars And Breaks Bank Of England Records

Mortgage Points A Complete Guide Rocket Mortgage

What Are Mortgage Points