401k max contribution 2021 calculator

This is up from 57000 and 63500 in. In this article we breakdown the Solo 401K Contribution limits for 2021.

401k Contribution Calculator Step By Step Guide With Examples

Company match assumption is between 0 100 of employee contribution.

. If you contributed 5 percent of your salary to a 401k plan your contribution would be 96 a pay period but your pay would fall by 82 assuming you were in the 15 percent tax bracket according to a calculator from Fidelity Investments. You could consider a 401k for 2021. For 2021 the max is 58000 and 64500 if you are 50 years old or older.

Must contain at least 4 different symbols. Backward since the average 401k contribution limits were lower in the past. A true pittance considering that the allowable annual contribution in 2021 is 3600 rising to 3650 in 2022 for those with individual health plans and 7200 for those with family coverage.

PAY CALCULATOR Click and drag the sliders Pay Rate. The numbers are more forward-looking vs. If you want to get a larger contribution for 2020 you can only do a cash balance plan or defined benefit plan.

This is in addition to its basic coverage that begins at 50 million and is. 6 to 30 characters long. ASCII characters only characters found on a standard US keyboard.

Contributing the max to both accounts results in a total tax deferral of 41000 per year not including catch-up contributions. For 2022 the 401k contribution limit is 20500 in salary deferrals. The contribution limit is 56000 in 2019 and 57000 in 2020.

A contribution is the amount an employer and employees including self-employed individuals pay into a retirement plan. In June 2021 iTrust announced that it began using Coinbase Custody to secure its digital assets up to 370 million. 8 Sticking with our example above maxing out your Roth IRA and investing 6000 into your account brings your total retirement savings for the year to 9750.

The elective deferral limit for SIMPLE plans is 100 of compensation or. You can open a solo 401k for your 1099 income in 2020. You can correct the contribution and deposit the correct amount and take the tax deduction.

Contributions to a traditional 401k are always tax-deductible. This contribution limit applies to. No after-tax income contribution although more power to you if you have the disposable income to do so.

Just a little bit short of your retirement savings goal. The maximum 401k contribution by an employee in 2022 is 20500. If you are age 50 or older you can contribute an extra 6500 via a catch-up contribution in both 2021 and 2022.

For defined contribution plan participants or Individual Retirement Account owners who die after December 31 2019 the SECURE Act requires the entire balance of the participants account be distributed within ten years. The standard max 401k 2022 limit is 20500. How to Max Out a 401k.

In 2021 you can put up to 6000 into a Roth IRA and an extra 1000 catch-up contribution if youre age 50 or older. This will mean only a half year HSA contribution in 2018 2200 inflation adjustment as I go on Medicare in July. Yes you can max out both your 401k and 457 plan up to the maximum allowed by the IRS which is 20500 for each account.

Plus if youre over age 50 you get a larger catch-up contribution maximum with the 401k 6500 compared to 1000 in the IRA. All contributions are subject to 100 vesting. This is a great way to maximize your tax advantages for those looking to quickly bulk up their retirement accounts.

The rate of return assumptions are between 0 10. 401k plans 403b plans the federal Thrift Savings Plan and most 457 pension plans. They may make a 4 percent matching contribution a 35 percent matching contribution or a 3 percent non-elective contribution.

For the tax year 2022 which youll file a return for in 2023 that limit stands at 20500 which is up 1000 from the 2021 level. I turn 65 in July 2018. In 2021 and 2022 you can contribute up to 6000 per year into a Traditional IRA.

For instance in 2022 the 401k contribution limits rose 1000 from 2021 You start full-time employment at age 22 at a company that provides a 401k without a company match. PAY NOTES Monthly guarantee. Hi Ali you have to contribute the same percentage of W2 to the eligible employees including yourself.

For example suppose you had gross pay of 50000 a year and got paid every two weeks. If you are 50 years of age or. What Does A 401k Third Party Administrator Do.

The pension plan is also separate. There will be those with less and those which much MUCH greater balances. 61000 is the total 401k contribution for.

According to a Vanguard study only 12 of plan participants managed to max out their 401k in 2019. Individuals over the age of 50 can contribute an additional 6500 in catch-up contributions. What you provide as the employee and the match from your employer if applicable.

19500 in 2020 and 2021 19000 in 2019 18500 in 2018 and 18000 in 2015 - 2017 or 100 of the employees compensation whichever is less. This is an increase from the limit of 19500 that was set for 2020 and 2021. 65 hours Reserve guarantee.

They may match 50 of your contribution up to 6 which means if you contribute 6 into your 401k account they will contribute 3. ALV Average Line Value - 2 hrs. Below is a chart that further breaks down the 401k contribution limits for 2022 according to IRSgov.

You can only contribute a certain amount to your 401k each year. However for an IRA in 2021 and 2022 the annual contribution limit is only 6000. The Low Mid and High columns should successfully encapsulate about 80 of all 401K contributors who max out their contributions each year.

The total combined employeremployee contribution limit increased by 1000 in 2021 to 58000 or 64500 if youre over 50 and making the catch-up contributions. Use the solo 401k calculator to find out how much you can contribute. Remaining VEOP pilots will separate over 2021.

I stay below the ACA cliff with 6500 deductible IRA not Roth contributions and 4400 HSA contribution plus half of self employment taxes keeping me below 4x 11880 this year 2017. Many financial groups offer a Retirement Calculator Tool on their website typically free for anyone to use. Your 457 contribution is separate.

The 50 annual fee applies to draws over 50000 and if you pay off and close the account within 24 months you may have to pay a 2 percent termination fee max 450. The contributions at County hospital A do not affect your solo 401k contributions. Contribution limits to a Solo 401k are very high.

The maximum amount you can contribute for 2021 is 19500. If you are 50 years of age or older you can contribute up to 7000 per year. Yet most people dont know how to max out a 401k.

There are two sides to your contribution. Does Max 401k Contribution Include Employer Match. It should go up by 500 every 2 4 years based on history.

Solo 401k Contribution Limits And Types

Solo 401k Contribution Limits And Types

The Maximum 401k Contribution Limit Financial Samurai

Solo 401k Contribution Limits And Types

After Tax Contributions 2021 Blakely Walters

The Maximum 401k Contribution Limit Financial Samurai

Free 401k Calculator For Excel Calculate Your 401k Savings

401k Employee Contribution Calculator Soothsawyer

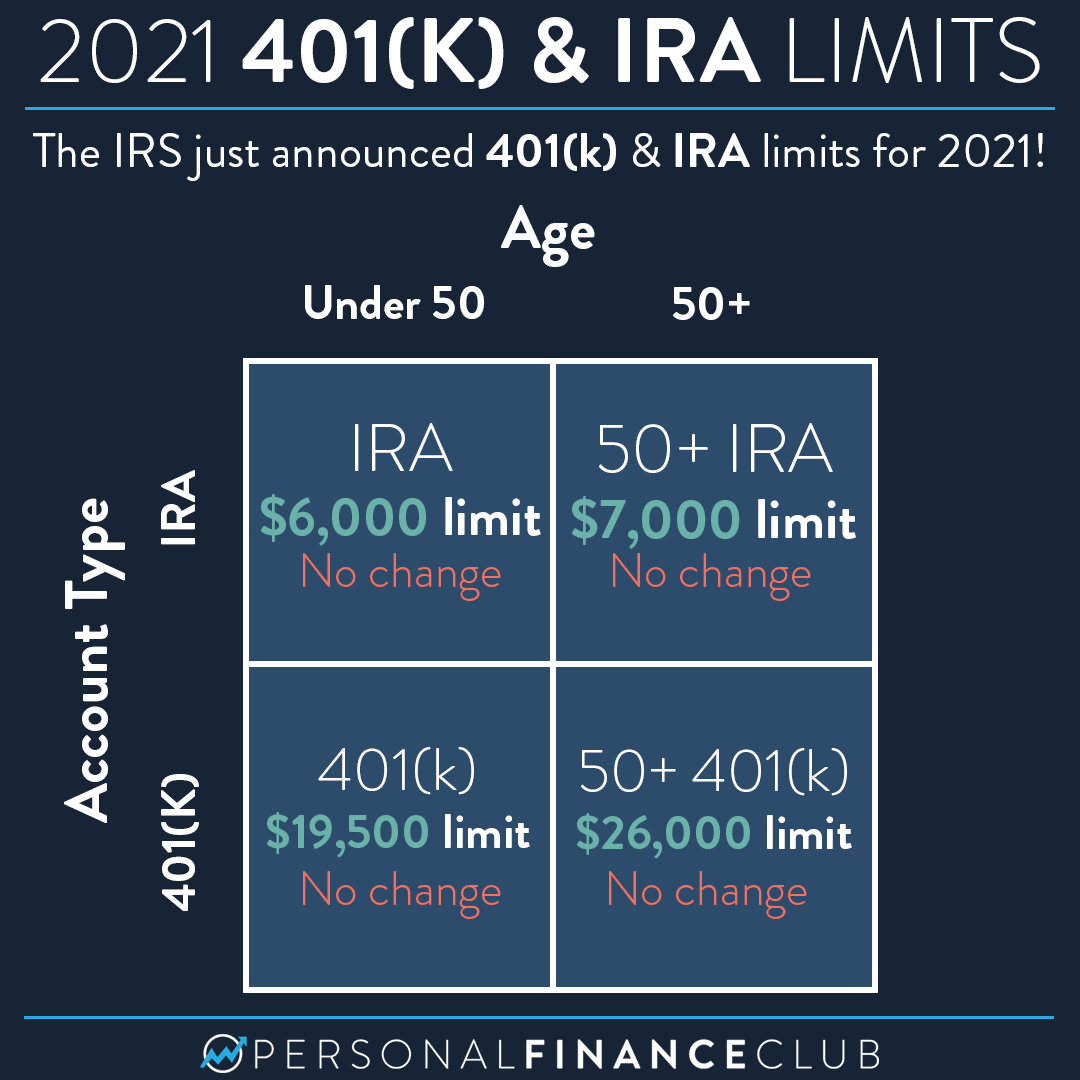

2021 Contribution Limits For 401 K And Ira Personal Finance Club

401k Employee Contribution Calculator Soothsawyer

The Maximum 401k Contribution Limit Financial Samurai

How Much Can I Contribute To My Self Employed 401k Plan

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

How Much Can I Contribute To My Self Employed 401k Plan

Solo 401k Contribution Limits And Types

Employer 401 K Maximum Contribution Limit 2021 38 500

Here S How To Calculate Solo 401 K Contribution Limits